The Emerging Trends in Digital Transformation for Insurance Industry

Overview

In this digital age, the insurers have already started implementing various digital strategies and we have compiled a list of digital trends that might come true in this year.

The Hurdles of Legacy Systems and IT Silos

It’s tough time for the insurance industry with complex raft of challenges to deal with in the upcoming years from regulatory factors, incompatible and outdated legacy systems. To realize the full value of their technology investments, insurance companies must overcome the obstacles to growth presented by incompatible legacy technology. Forty-seven percent of survey respondents also say lack of collaboration with the IT function is preventing them from realizing their technology investments’ value.

Another important hurdle to address is related to the workforce. Ninety percent of insurers expect digital innovation to cause a significant headcount reduction. These concerns also stand in the way of digital transformation across financial services, yet four in 10 insurers expect their technology investments to improve employee retention and satisfaction, reducing turnover.

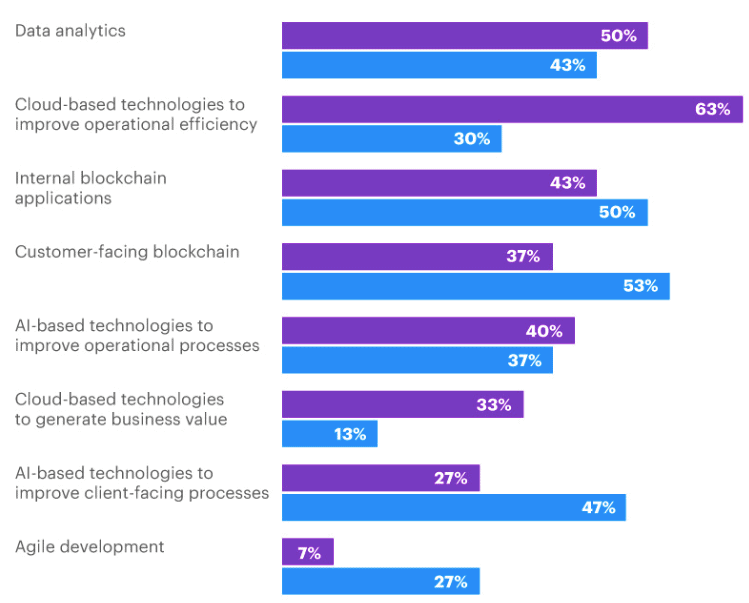

In a recent survey by Deloitte on the digital transformation in the insurance sector called on the insurance industry to transform their operations digitally. Of the users surveyed, 7 out of 10 insurers have already started implementing various digital strategies. The survey suggested that there are an overall 30% improvements in underwriting process after they made the whole process online. Their Net Income increased by 45% YoY and EBITDA improved by 28%. The survey overwhelmingly suggests that the insurance industry is moving their business processes and operations online with great results. | Cloud is having the biggest impact on insurance companies today

Image Source: Accenture |

In a recent survey by Deloitte on the digital transformation in the insurance sector called on the insurance industry to transform their operations digitally. Of the users surveyed, 7 out of 10 insurers have already started implementing various digital strategies. The survey suggested that there are an overall 30% improvements in underwriting process after they made the whole process online. Their Net Income increased by 45% YoY and EBITDA improved by 28%. The survey overwhelmingly suggests that the insurance industry is moving their business processes and operations online with great results. Cloud is having the biggest impact on insurance companies today

Image Source: Accenture |

After studying many surveys and speaking with many industry leaders we have compiled a list of trends that might come true in the coming years.

Interconnected Self-Service Portals and Systems:

We all know communication is the key for any digital businesses in the insurance industry. Insurance providers have already implemented various portals for the customers, partners and any other stakeholders. This year, there will be attempts made to consolidate them on a single system and to move away from different legacy technologies and create an omnichannel digital ecosystem which is surely a boon for all the stakeholders.

Personalized Dashboards & Widgets:

Viewing the sales performance and financial data from a top view is vital in making informed decisions. Personalized dashboards and standard widgets will benefit the customers and partners greatly by providing a bird’s eye view of policies, product prices, claims and payment dates. Getting all vital information on a single view is will become an inseparable part of an insurance SaaS system.

Compare and Buy:

In this digital era, customers will be doing a lot of research before purchasing any insurance plan and would move online to compare multiple plan provided in various insurance portals and make a better purchase decision. In addition to this, such online portals will get them to understand the terms & conditions of any plan, premium rating, payment terms and much more before coming to a conclusion on the purchase of their life, medical, property, motor or any other insurance policies. This is where the insurance providers mobility solutions will act as a catalyst for increased sales performance, revenue growth and customer retention rate.

Seamless Claims Management:

Now, when the claims process turns digital – Policyholders can submit claims by uploading the photos of incident, supported documents, and claim form upon the loss. Moreover, policyholders can keep track their claim status while getting auto-alerts and notification on the updates. On the other hand, insurers will assign a respective claims examiner in handling the case upon settlement. The whole process of submitting the claim, tracking the status and settling the payable amount including any excess fee to pay will go online.

Cloud Computing:

We all know the future is in the clouds and the insurance providers have already agreed that they are either moving some or all of their business operations over the cloud or they have already shifted to a cloud storage.

Big Data And Analytics:

Upon digital transformation and getting hands-on with digital strategies and approach, Insurance providers could see more and more users coming online to purchase insurance plan. Insurers can utilize the huge amount of data to understand customer behaviour to upsell and cross-sell products and help him make informed purchase decisions and also, can understand their customer requirements and adjust the policies accordingly to meet their needs. With the advanced analytics, Insurance providers will be able to predict the best selling products and forecast the sales performance.

Digital transformation with Agiliux

As a sign of digital transformation in the insurance industry, we can see changes and transformation in both the strategies they use and approach they do such as – the automation of claim submission and settlement, online policy issuance and eCert generation and much more. Certainly, this makes evident that Insurance providers that adopt early to this changing digital era and undertake the digital strategies will thrive to success and go ahead their competitors.

Want to take lead in the insurance market with digital solutions? Connect with us to book a free consultation for your project.

Who We Are?

Agiliux is a Software-as-a-Service that provides insurance professionals with an end-to-end workflow and management platform.

Suggested Further Reading:

- Retrieved from Digital transformation is remaking insurance.

- Retrieved from Why The Insurance Industry Is Embracing Digital Transformation?

Connect with us to find out more on Agiliux and Cloud Insurance

Agiliux is a Software-as-a-Service that provides insurance professionals with an end-to-end workflow and management platform.

Agiliux Cloud Insurance:

1. A digital connectivity platform for global and regional teams with multiple currencies, tax rates, languages and regulatory requirements

2. Seamlessly connect your legacy systems to offer cutting edge digital solutions, without disrupting the existing infrastructure and processes.

3. With SaaS, upgrades are applied continuously without waiting for your IT staff and give you full value from your software investment

4. Start small with what you need and add more advanced features as you grow and ready to scale. Never pay for what you don’t use

Authored By:

| Nur Hanisah Izzul Fikri, Insurance Analyst, Agiliux | Sarabjeet Kaur, Chief Product Officer, Agiliux |

|---|---|

Authored By:

Nur Hanisah Izzul Fikri,

Insurance Analyst, Agiliux

Sarabjeet Kaur,

Chief Product Officer, Agiliux