Revolutionising UK Insurance with Agiliux Cloud Innovations

Agiliux is ready to support digital transformation initiatives including BP2, happening in UK insurance Market with advanced API-driven solutions. Our cloud-based software streamlines processes fosters electronic data exchange, and will also ensure necessary compliances with the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA).

Step into the future of the UK Insurance Industry with Agiliux through our AI driven solutions tailored for the UK insurance market. Be compliant with Lloyd’s of London vision for UK insurance market with Blueprint Two (BP2) upgrade and stay on top of your game.

API Integration: The Core of Modern Insurance Operations

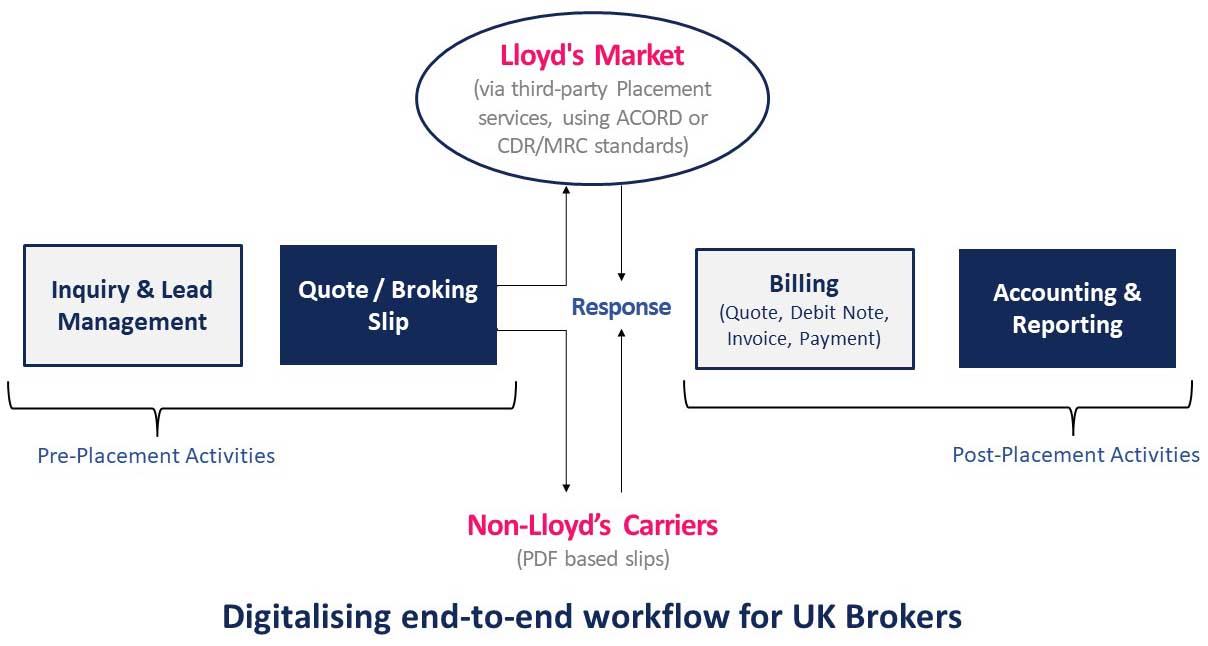

Have you heard of Lloyd’s of London Blueprint Two (BP2) digitalisation plan for the UK Insurance Market? According to that plan, API integration will play pivotal role in making sure you are compliant with UK insurance market. Our API expertise is crucial in Lloyd’s initiative to modernise the London Market, aligning with Blueprint 2’s digitalisation plan. We specialise in broker software solutions, implementing end-to-end digitalisation of broker operations, following CDR/MRC standards for ePlacement, working with services like Whitespace, InsureMO & PPL, to offer a comprehensive solution.

Agiliux Commercial – All In One Solution

Agiliux Commercial transforms insurance brokerage processes by offering comprehensive solutions from broking slip generation to Placement and technical accounting, in a single system. With out-of-box support of more than 80 Commercial Business lines and Whitespace integration*, our platform ensures tailored solutions prioritising accuracy and compliance with global regulations, including Lloyd’s of London, FCA, and PRA.

With a strong focus on data security, user access control, and compliance with regulatory requirements and our UK-based cloud deployment model that ensures data stays within the UK, mitigating cyber-attack vulnerability, we believe we are ready to help transform UK insurance industry.

Need more information?

Explore the Advanced Capabilities of Agiliux Brokers Solutions

- Generate Broking Slip in easy templates available for 80+ Commercial Business Lines

- Access to Real-time Policy Quotes and Premium Calculations through API integrations with Insurers

- Complete Policy Management to enable easy cancellation, endorsement or renewals

- Streamline Claims Management from Tracking to Settlement

- Timely Status Updates and Notifications

- Centralised Master Data for All Insurance Partners

- Integrated Payment Gateway for Secure Online Payments

- Scalable and Customisable Software tailored for Insurance Intermediaries

- Centralised Software for Complete Operations Management integrating multiple channels

- Efficient Sales Management from Lead Management to Final Payment

- Personalised Marketing and Customer Outreach Capabilities

- Access to Customised Dashboards and Financial Reporting

- Compliant with Lloyd’s Market and FCA/PRA Regulations

- Centralised Customer Support Channels

Embrace the digital future with Agiliux’s innovative broking solutions. Contact Agiliux today to discover how we can revolutionise your insurance business operations through our technical expertise and help you achieve faster growth.

Agiliux goes beyond basic compliance, offering tools and expertise to navigate the evolving regulatory landscape. Contact us to discuss how we can tailor our solutions to your specific needs.

Lloyd’s of London Blueprint Two (BP2) upgrade July 2024

Agiliux Empowered Oneglobal to Transform Insurance Broking Operations

Agiliux has earned a prestigious invitation from the Global Entrepreneur Programme (or GEP), championed by the UK Department for Business and Trade (or DBT). Recognizing Agiliux’s innovation and global potential, the GEP offers tailored support for the company’s expansion, bolstering our presence in the UK market. With established operations and an office in the UK, Agiliux is all set to push its mission to transform the commercial insurance industry further.