Transform Your Distribution Channels with

Agiliux for Insurers

Agiliux helps insurance companies optimise their traditional distribution channels while simplifying collaboration with external partners and insurtechs. Unlock new opportunities and streamline partnerships with Agiliux’s advanced solutions.

Sell Insurance Online

Agiliux empowers insurers to sell personal insurance online via a customisable website or mobile app, presenting multiple types of insurance through a dedicated, seamless customer journey.

Our platform offers real‑time quotes, add‑on purchases, integrated payment gateway, and instant policy issuance, all with a UI/UX that reflects your corporate brand.

Sell Insurance via Agents

Agiliux provides insurers with a robust agents portal accessible via website or mobile app, enabling agents to create and manage leads and generate tailored quotes for assigned products.

Additionally, our solution includes a comprehensive backend for agency management—assigning leads, monitoring sales, tracking commissions, and generating detailed performance reports.

Sell Insurance via Partners

Agiliux enables insurers to sell insurance via partners through affiliate websites with partner branding, while all sales transactions are processed securely within the Agiliux backend system.

Our solution offers APIs for embedded insurance, allowing partners to integrate our services into their own websites or mobile apps while maintaining full backend control over transactions.

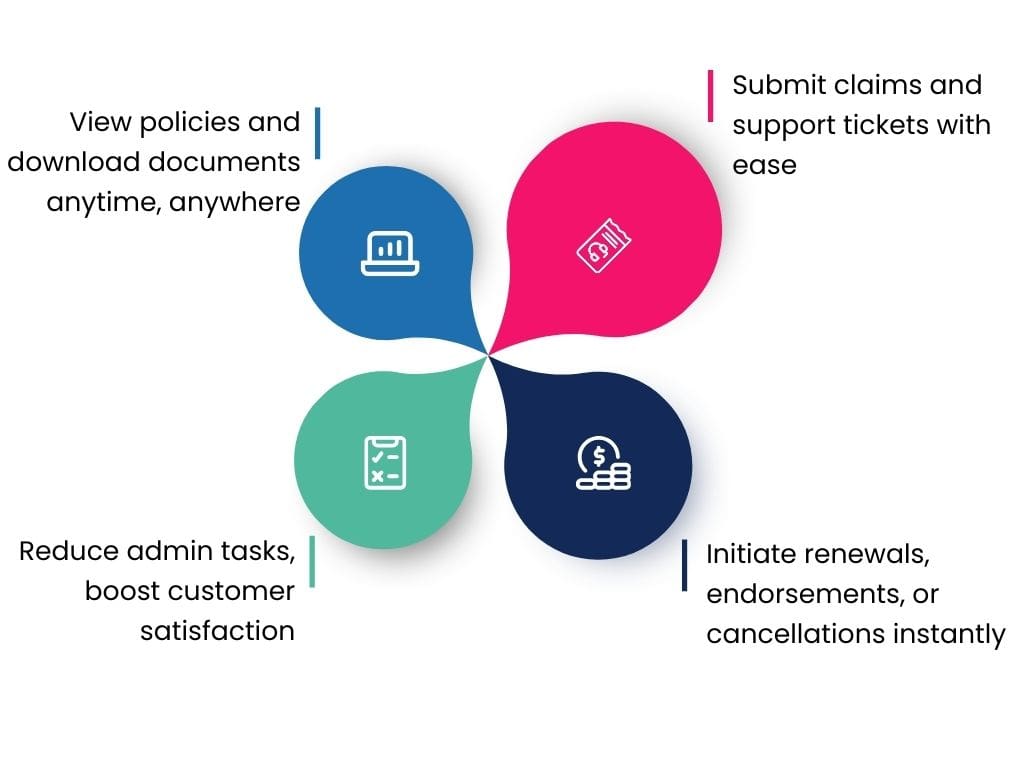

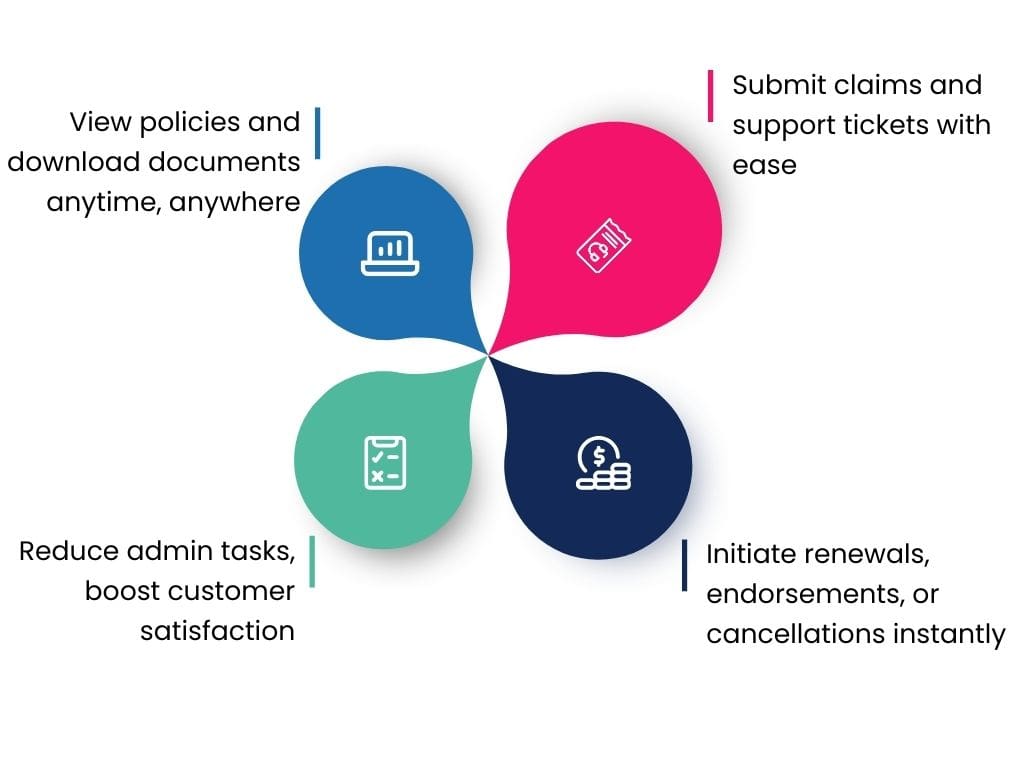

Customer Self-service

Agiliux offers a customer self-service portal via web or mobile app, where policyholders can access their policies, download documents, and initiate cancellations, renewals, or endorsements.

The portal also allows customers to apply for claims and submit support tickets, enhancing engagement, improving service efficiency, and driving higher retention rates.

Customer Self-service

Agiliux offers a customer self-service portal via web or mobile app, where policyholders can access their policies, download documents, and initiate cancellations, renewals, or endorsements.

The portal also allows customers to apply for claims and submit support tickets, enhancing engagement, improving service efficiency, and driving higher retention rates.

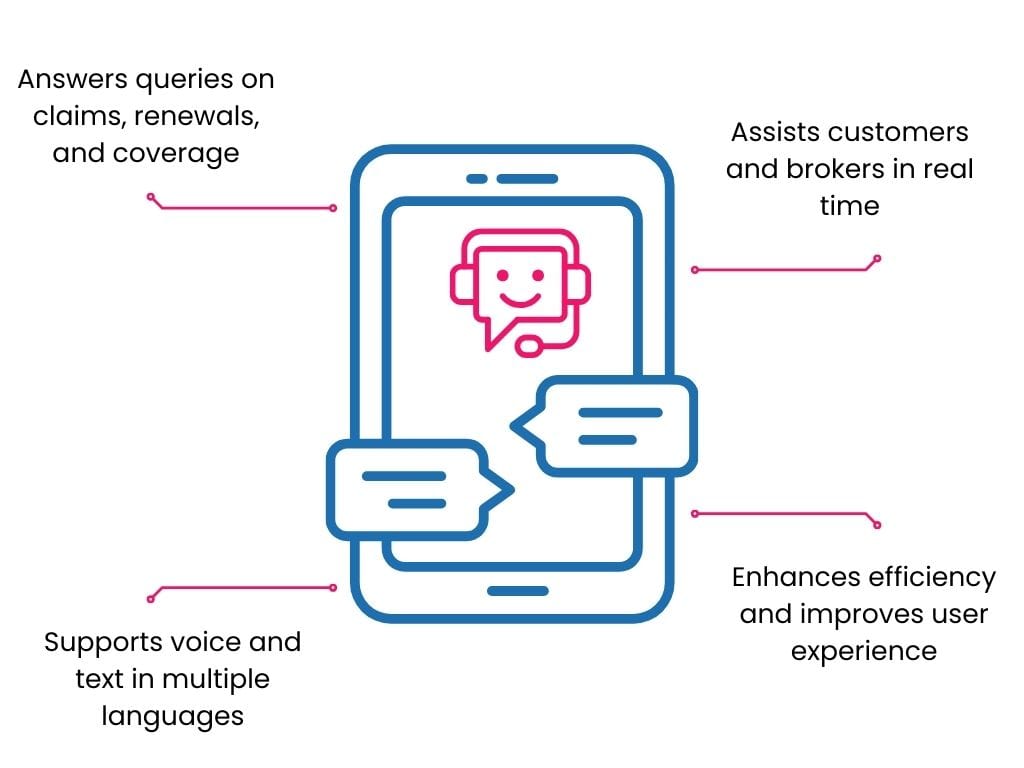

Intelligent AI Chat

Agiliux Intelligent AI Chat enhances insurers’ digital channels by supporting website visitors in purchasing policies and answering queries regarding policy details, renewals, endorsements, and claims. It offers text and audio support in hundreds of languages.

Seamlessly integrated with Agiliux systems, our AI Chat enables insurers to provide instant, automated support to customers and agents, improving operational efficiency and elevating the overall customer experience.

Inquiry & Lead Management

Agiliux’s inquiry and lead management module captures enquiries from any channel, ensuring prompt follow-up and efficient management of quotes for personal insurance.

Automated follow-ups and streamlined quote processing help insurers capture every sales opportunity, boost conversion rates, and deliver a responsive digital experience.

Inquiry & Lead Management

Agiliux’s inquiry and lead management module captures enquiries from any channel, ensuring prompt follow-up and efficient management of quotes for personal insurance.

Automated follow-ups and streamlined quote processing help insurers capture every sales opportunity, boost conversion rates, and deliver a responsive digital experience.

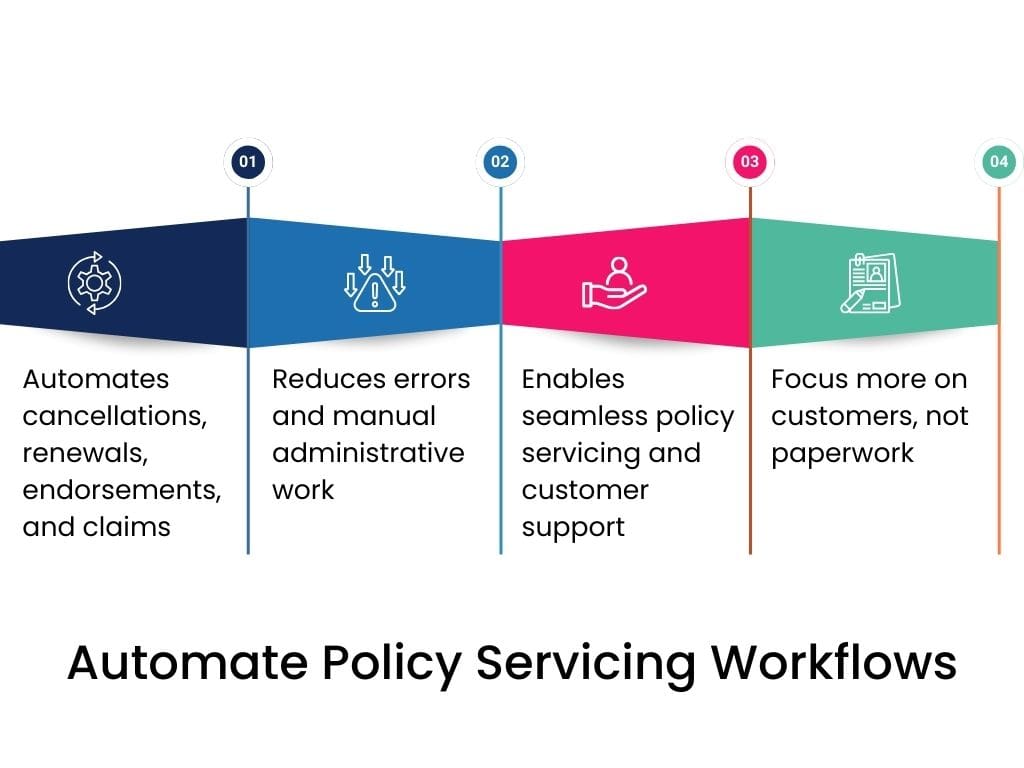

Operations Management

Agiliux streamlines operations with automated policy management—covering cancellations, renewals, and endorsements—and efficient handling of claims for personal insurance.

By reducing manual interventions and errors, our system allows insurers to focus on customer service, driving improved efficiency and overall operational excellence.

Customer Support Helpdesk

Agiliux provides an advanced customer support helpdesk featuring a ticketing system to manage service requests, with omnichannel support via email, SMS, WhatsApp, and phone.

SLA-based escalation protocols ensure timely resolution of issues, enhancing service reliability and significantly boosting customer satisfaction for insurers.

Billing & Payments

Agiliux automates billing and payments, supporting both online and offline transactions with accurate payment allocation, receipt issuance, and seamless data push to finance systems.

Enhanced payment processing improves cash flow management and financial accuracy, reducing manual tasks and ensuring secure, timely transactions.

Dashboard and Reports

Agiliux offers customisable dashboards and robust reporting tools that enable insurers to create new reports, modify existing ones, and export data in clear tabular formats with visual charts.

Scheduled report delivery and personalised dashboard designs provide continuous real‑time performance monitoring, supporting informed, data‑driven decision-making.

Integration with Core Backend Systems

Agiliux Digital operates as a standalone solution interfacing with your core backend systems. All frontend applications run on Agiliux and sync data with existing systems via real‑time APIs or batch processes.

For insurers using middle‑office solutions like InsureMO, Agiliux offers fast deployment options, ensuring consolidated data flow, enhanced transparency, and streamlined operations.

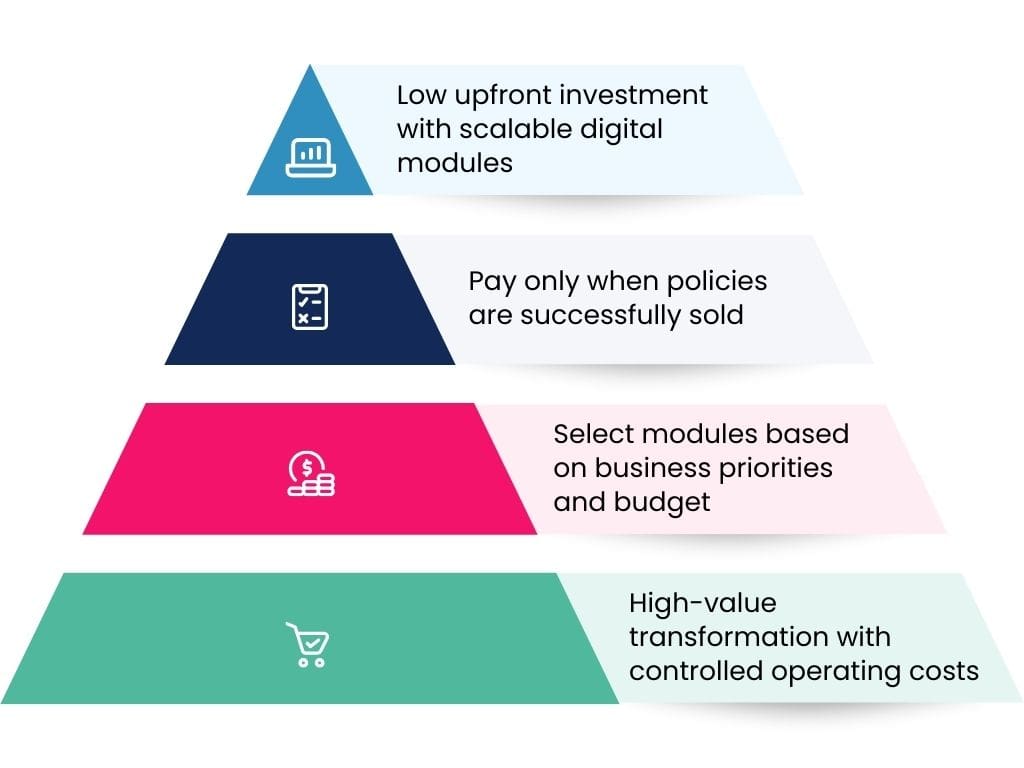

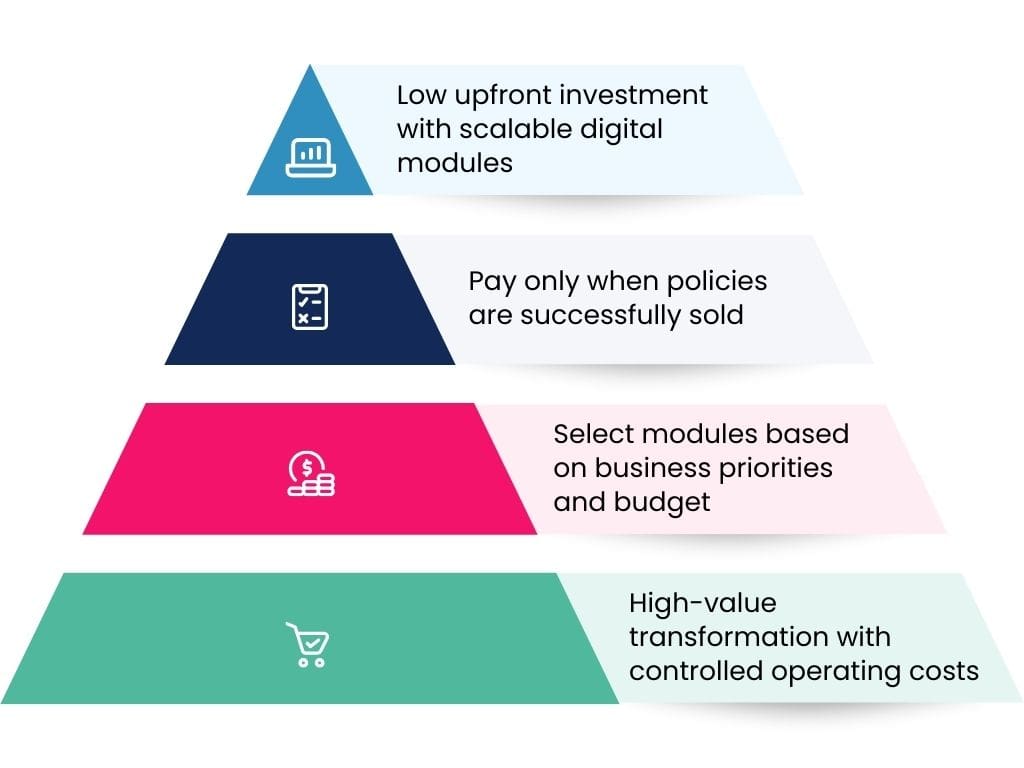

Investment & Pricing Model

Agiliux Digital is available with a low initial investment and operates on a pay‑as‑you‑sell fee model, allowing insurers to choose the modules they wish to implement and prioritise them as needed.

This flexible, cost‑effective approach ensures that expenses remain under control while delivering high‑value digital transformation, with fees incurred only upon policy sales.

Product Development and Management

Agiliux Digital is available with a low initial investment and operates on a pay‑as‑you‑sell fee model, allowing insurers to choose the modules they wish to implement and prioritise them as needed.

This flexible, cost‑effective approach ensures that expenses remain under control while delivering high‑value digital transformation, with fees incurred only upon policy sales.

What Makes Agiliux the Smart Choice for Global Brokers?

Learn how Agiliux supports multi-currency, multi-language, and scalable solutions, helping brokers thrive internationally.

Enhance Your Reinsurance Broking with Agiliux

Experience seamless reinsurance operations. Contact us for a live demo or sign up for a free 2-week Proof of Concept (POC) to see Agiliux in action.