Simplify Bancassurance with

Agiliux for Banks

Agiliux enables banks to manage insurance sales across multiple distribution channels with ease. Simplify your collaboration with multiple insurers and streamline your bancassurance operations for better efficiency and performance.

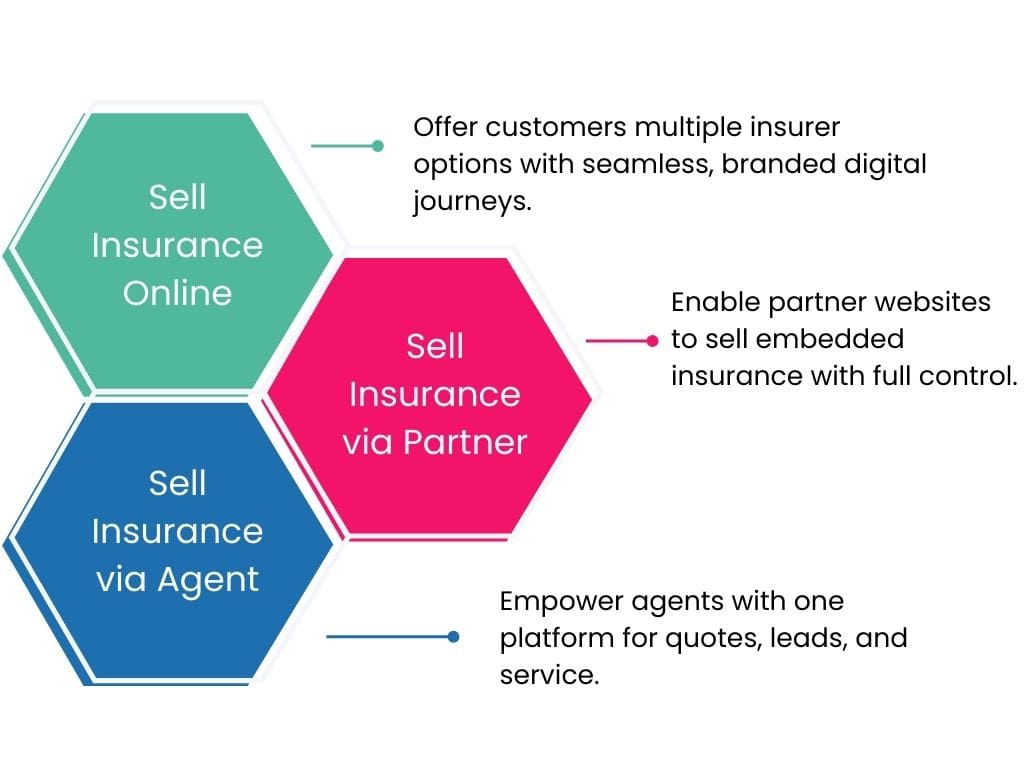

Sell Insurance Online

Agiliux empowers banks to sell insurance online via a customisable website or mobile app, displaying products from numerous insurers to offer customers a wider choice.

Our platform delivers distinct customer journeys per product, enabling multi‑insurer quotes, add‑on purchases, secure payments, and real‑time policy issuance with seamless branding.

Sell Insurance via Agents

Agiliux provides banks with a unified agents portal and mobile app, so their agents can access all insurer products from one common platform instead of multiple portals.

This streamlined portal allows agents to create and manage leads, generate accurate quotes, and raise service requests, boosting efficiency and customer support.

Sell Insurance via Partners

Agiliux enables banks to extend digital sales through affiliate websites with partner branding, while all transactions occur securely within the Agiliux backend.

Our solution offers APIs for selling embedded insurance, allowing partners to integrate insurance sales into their own websites or apps, increasing digital sales reach.

Customer Self-service

Agiliux delivers a customer self-service portal via web or mobile app, where policyholders can view policies, download documents, and initiate renewals, cancellations, endorsements, or claims.

By enabling customers to manage their own policies and submit requests, banks can drive repeat business and dramatically improve customer experience.

Customer Self-service

Agiliux delivers a customer self-service portal via web or mobile app, where policyholders can view policies, download documents, and initiate renewals, cancellations, endorsements, or claims.

By enabling customers to manage their own policies and submit requests, banks can drive repeat business and dramatically improve customer experience.

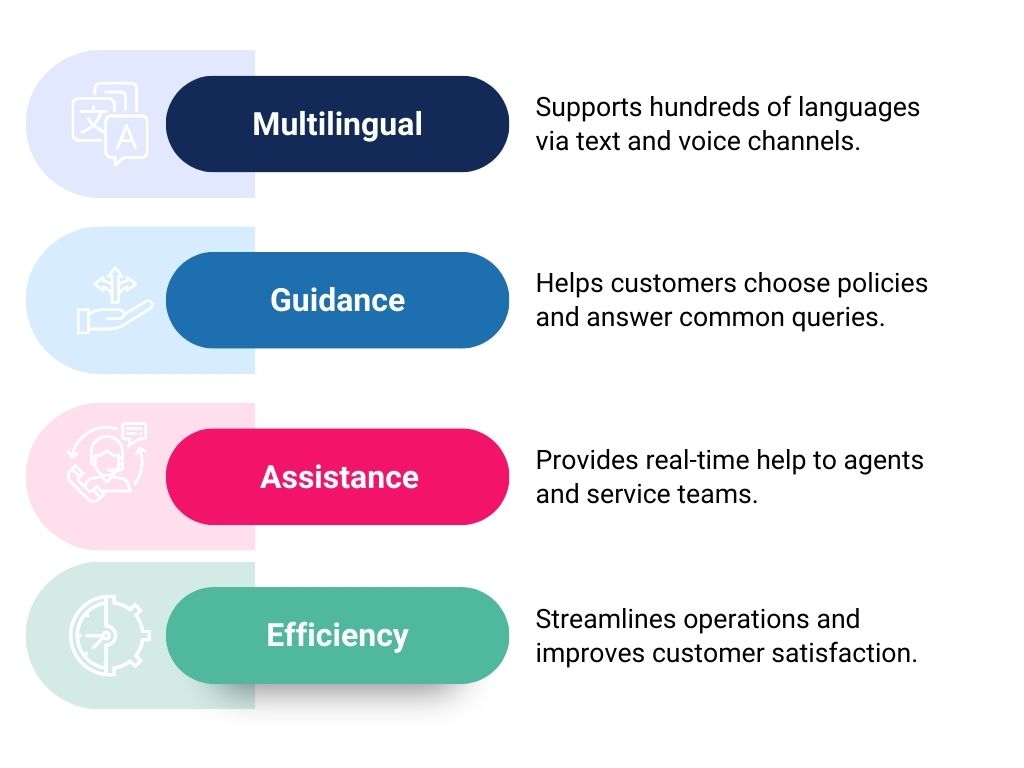

Intelligent AI Chat

Agiliux Intelligent AI Chat equips banks with a virtual assistant that guides website visitors in purchasing policies and handling queries on expiry, coverage, renewals, endorsements, and claims. It supports both text and audio in hundreds of languages.

Fully integrated with Agiliux Digital, our AI Chat assists bank agents and customer service teams in obtaining rapid support, streamlining processes, and boosting customer satisfaction and repeat business.

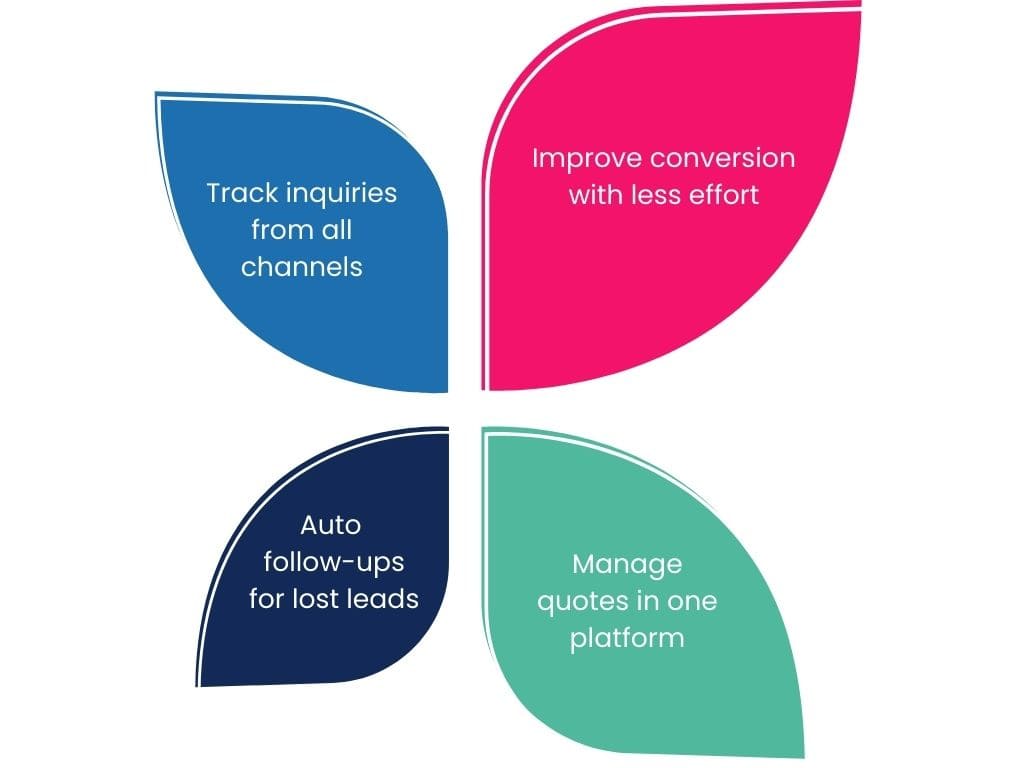

Inquiry & Lead Management

Agiliux’s inquiry and lead management module captures enquiries from every channel, ensuring prompt follow-up and efficient quote management to secure every sales opportunity.

Automated lead tracking and quote management help banks boost conversion rates, reduce manual tasks, and deliver a responsive digital sales process.

Inquiry & Lead Management

Agiliux’s inquiry and lead management module captures enquiries from every channel, ensuring prompt follow-up and efficient quote management to secure every sales opportunity.

Automated lead tracking and quote management help banks boost conversion rates, reduce manual tasks, and deliver a responsive digital sales process.

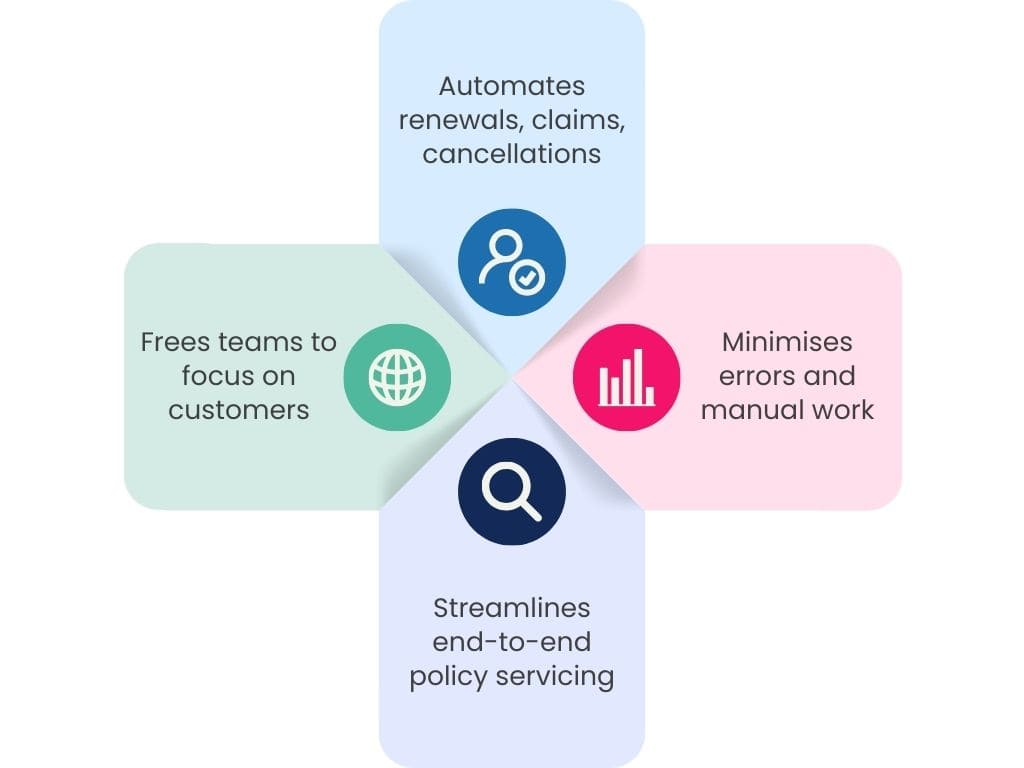

Operations Management

Agiliux streamlines operations by automating policy management—covering cancellations, renewals, and endorsements—and facilitating efficient claims processing for personal insurance.

By reducing manual interventions and administrative errors, banks can focus on customer service, enhance operational efficiency, and drive business growth.

Customer Support Helpdesk

Agiliux offers a robust customer support helpdesk featuring a ticketing system to manage service requests, with omnichannel support via email, SMS, WhatsApp, and phone.

Our SLA-based escalation process ensures timely resolution of issues, enhancing service reliability and boosting customer satisfaction for bank clients.

Billing & Payments

Agiliux automates billing and payments, supporting both online and offline transactions, accurate payment allocation, receipt issuance, and streamlined bank reconciliation.

This module improves cash flow management and financial accuracy, reducing administrative tasks and ensuring secure, timely processing of all payment transactions.

Dashboard and Reports

Agiliux features customisable dashboards and advanced reporting tools that allow banks to create new reports, customise existing ones, and design visual charts for real-time insights.

Scheduled report delivery and exportable formats (PDF/Excel) support continuous performance monitoring, enabling data-driven decision-making and strategic planning.

Integration with Core Backend Systems

Agiliux provides flexible API integration options: banks can choose native integration where insurer APIs are directly embedded in our system, or use InsureMO’s ready-to-use APIs for faster deployment.

This dual option simplifies data exchange with insurers, ensuring prompt access to the latest products and reducing integration complexities for seamless digital operations.

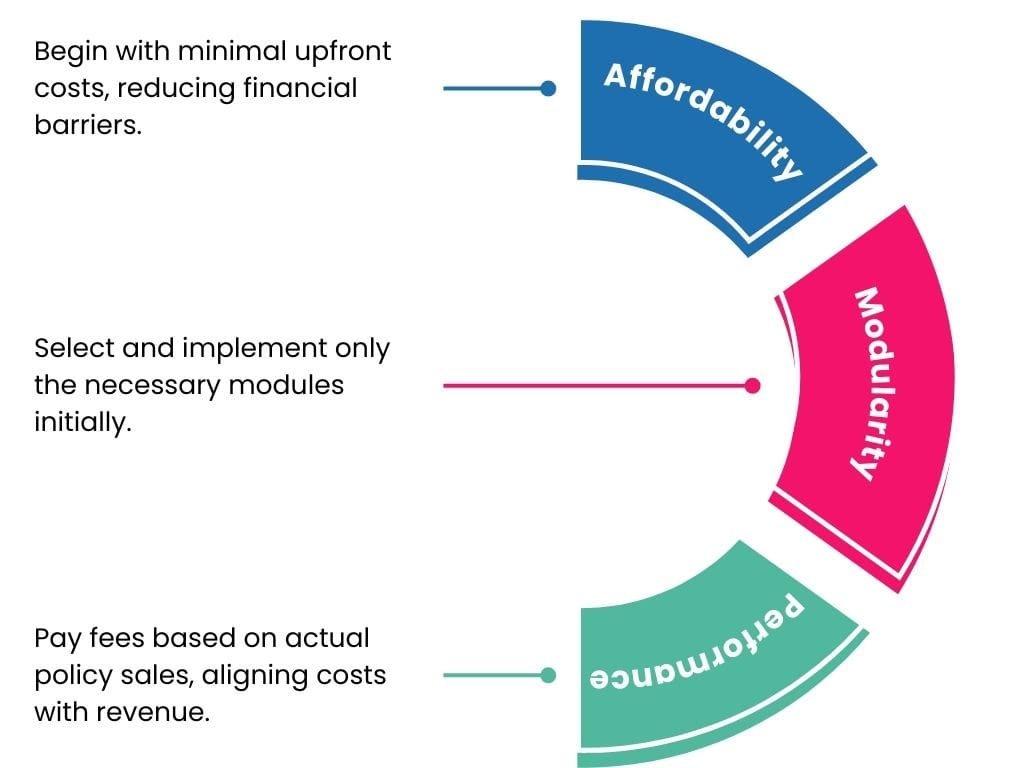

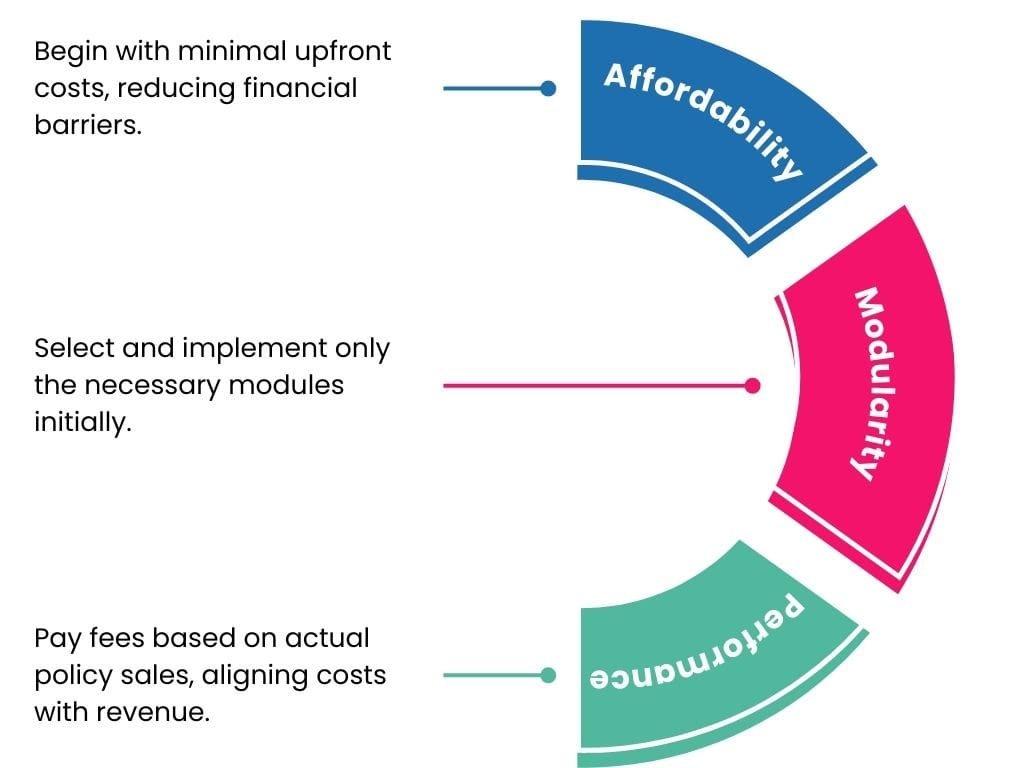

Investment & Pricing Model

Agiliux Digital is available with a low initial investment and operates on a pay‑as‑you‑sell fee model, allowing banks to choose the modules they wish to implement and prioritise them as needed.

This flexible, cost‑effective approach ensures that expenses remain under control while delivering high‑value digital transformation, with fees incurred only upon policy sales.

Investment & Pricing Model

Agiliux Digital is available with a low initial investment and operates on a pay‑as‑you‑sell fee model, allowing banks to choose the modules they wish to implement and prioritise them as needed.

This flexible, cost‑effective approach ensures that expenses remain under control while delivering high‑value digital transformation, with fees incurred only upon policy sales.

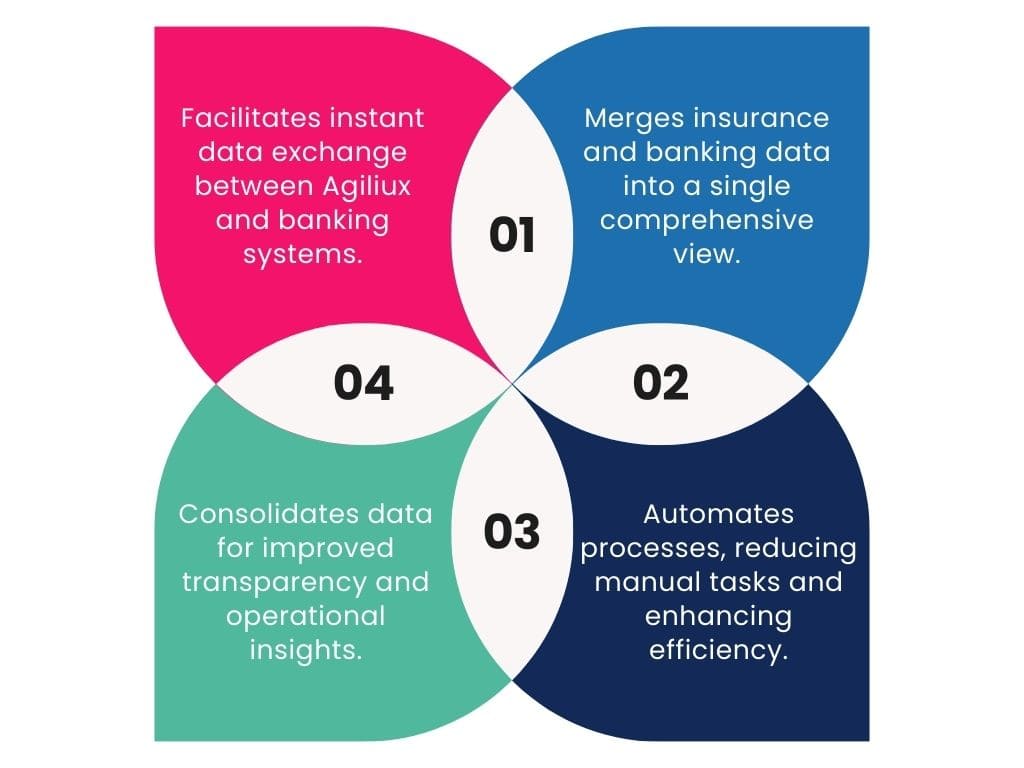

Integration with Core Banking Systems

Agiliux Digital runs as a separate system with its own frontend applications and integrates with insurer APIs, synchronising data with core banking systems via real‑time APIs or batch processes.

This integration consolidates insurance sales and customer data with existing bank systems, streamlining reporting and enhancing operational transparency for improved efficiency.

What Makes Agiliux the Smart Choice for Global Brokers?

Learn how Agiliux supports multi-currency, multi-language, and scalable solutions, helping brokers thrive internationally.