Agiliux Broker Solutions

A comprehensive cloud based modern solution for direct, reinsurance, and digital insurance brokers, to digitalise their end-to-end operations.

Digitalise Your Insurance Brokerage with Agiliux for Brokers

Agiliux enables digital brokers to offer online insurance through websites, partner portals, mobile apps, and agency networks. Integrated with multiple insurers, Agiliux streamlines your operations and helps you deliver a seamless customer experience.

Agiliux offers comprehensive solutions for brokers, including Agiliux Commercial for efficient commercial broking operations and Agiliux Digital for seamless digital distribution management. Simplify complex billing, payment, and accounting tasks with Agiliux tailored solutions. Boost broker efficiency today.

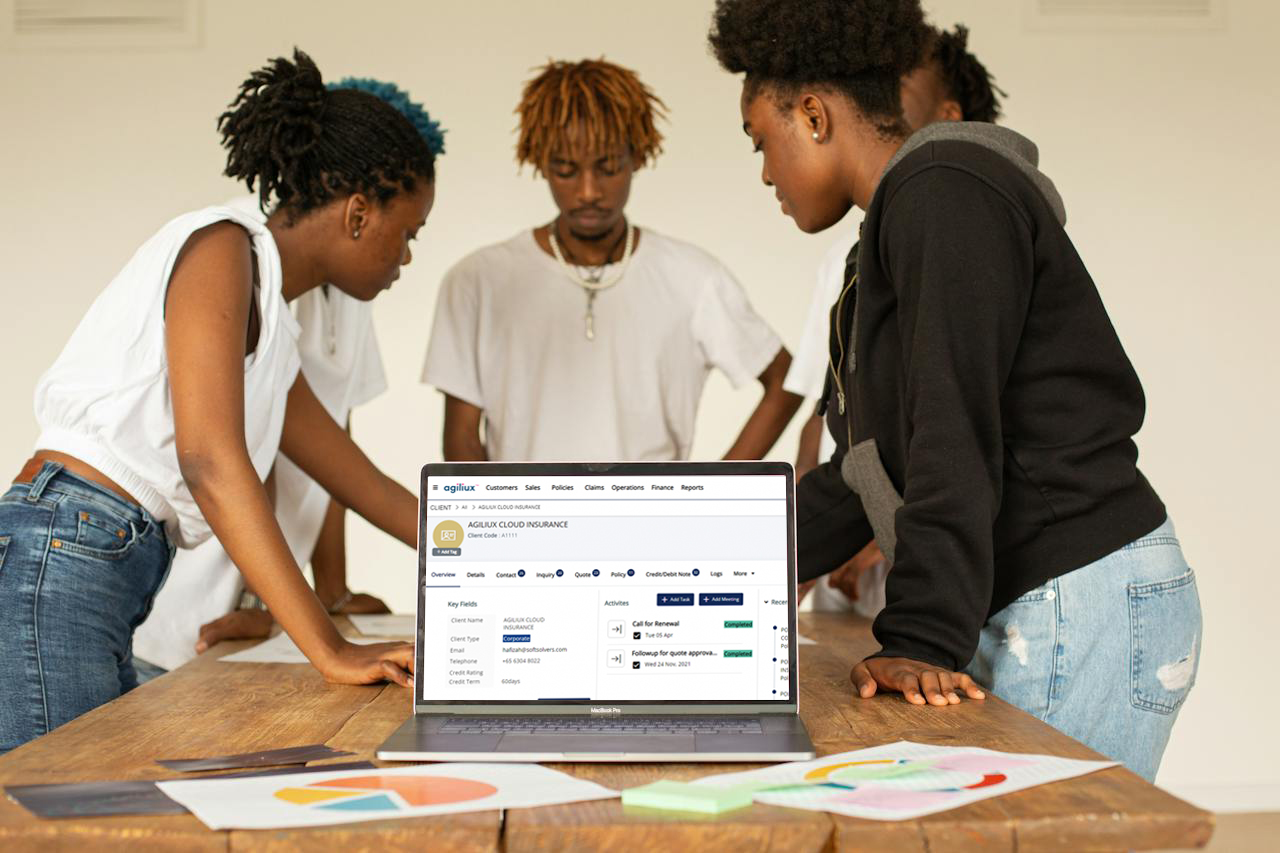

Commercial (Direct) Insurance Broking

Maximise your broking efficiency with Agiliux Commercial. Seamlessly manage broking operations from creating slips and quotes to secure billing and policy management. Streamline claims with submission, tracking, and status updates. Benefit from customised reporting for superior business analysis and control. Elevate your broker management system with Agiliux Commercial’s end-to-end solutions.

Digital Insurance Broking

Harness the power of Agiliux Digital, a centralised platform empowering digital brokers to streamline distribution channels effortlessly. Manage products, obtain quotes from multiple insurers, and facilitate seamless policy and claims management. Enjoy secure payments, custom dashboards, and robust reporting. Embrace customer self-service for enhanced engagement. Agiliux Digital supports diverse currencies, tax structures, and regulatory frameworks to stay ahead in this dynamic insurance industry.

Digital Insurance Broking

Harness the power of Agiliux Digital, a centralised platform empowering digital brokers to streamline distribution channels effortlessly. Manage products, obtain quotes from multiple insurers, and facilitate seamless policy and claims management. Enjoy secure payments, custom dashboards, and robust reporting. Embrace customer self-service for enhanced engagement. Agiliux Digital supports diverse currencies, tax structures, and regulatory frameworks to stay ahead in this dynamic insurance industry.

Re-insurance Broking

Agiliux Commercial offers comprehensive Reinsurance Broking solutions, supporting treaty and facultative businesses throughout the policy lifecycle. Centralise master data for enhanced security and visibility. Efficiently manage diverse contracts, claims, accounting, and generate insightful reports effortlessly. Streamline operations and ensure transparent, secure, and efficient reinsurance management with Agiliux Broker Solutions.

Technical Accounting

Easing the complexities of Customer & Insurer Billing, Payment and Accounting, which can have hundreds of things like Co-Brokers, Co-Insurers, Transactions in multiple currencies, dividing premium into multiple subsidiaries, tracking instalment plans, auto payment reminders, customer statements & aging reports, reconciliation among clients and insurers, regulatory reports and end of the year financial statements for your business.

Customer Self-Service Portal

Our integrated customer self-service portal revamps insurance operations for insurance brokers. Empowering your customers with access for real-time updates, policy downloads, and instant claim initiation, Agiliux Solutions for Brokers help in enhancing customer engagement through intelligent chatbots and integrated helpdesk support. Our Broker solutions facilitate streamlining communications, bolstering trust, and optimising operations under a centralised end-to-end broker management system.

Customer Self-Service Portal

Our integrated customer self-service portal revamps insurance operations for insurance brokers. Empowering your customers with access for real-time updates, policy downloads, and instant claim initiation, Agiliux Solutions for Brokers help in enhancing customer engagement through intelligent chatbots and integrated helpdesk support. Our Broker solutions facilitate streamlining communications, bolstering trust, and optimising operations under a centralised end-to-end broker management system.